FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

VIEW ALL EDUCATION & INSIGHTS

VIEW ALL EDUCATION & INSIGHTS

August 17, 2020

Making the Most of E-Banking

If you're reading this article online, you're probably at least somewhat tech-savvy. But when it comes to digital banking, you might be missing out on a few time-saving tricks. Here's how the Internet can help make your financial life easier.

Online banking: You don't have to leave home for everyday transactions, because financial institutions offer a slew of online banking tools. For example, you can set up free online bill pay, review your statements, see when checks clear and more. You can also make transfers between accounts at different financial institutions.

E-statements: With so much snail mail, it's easy to miss a statement without realizing a thief could have pocketed the information. You can increase your security — and lighten your carbon footprint — by signing up for electronic statements. You'll receive an email monthly or quarterly with account balances while still having access to that information anytime online.

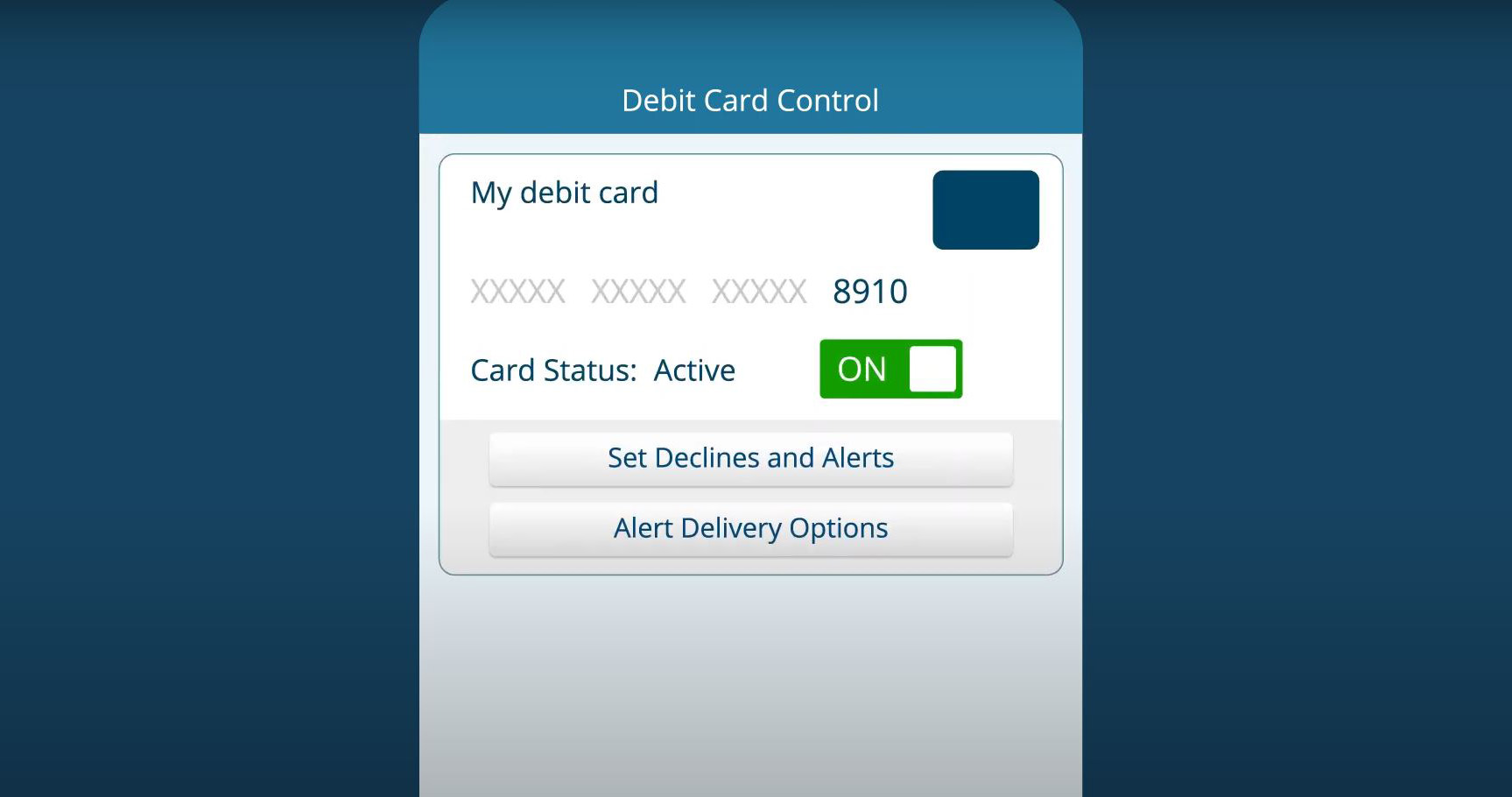

Mobile banking: Have you ever found yourself dining out with friends and wondering whether there's enough money in your account to pay for dessert? If you've downloaded a mobile app from your financial institution, you can use a smartphone or tablet to check your balance, pay bills and transfer money between accounts while on the go.

Getting mobile alerts can also increase your security by putting you in constant contact with your accounts. That's particularly important now: A NerdWallet study analyzing data on credit fraud indicates that cybercriminals are likely to make online shopping a particular target in the coming months. The sooner that you alert your credit union to a suspicious transaction, the more quickly it can limit any damage.

Automatic bill payments: Many people dedicate an hour or two at the end of each month to paying electric, gas, water and cable bills. Financial institutions that provide automatic bill payment services let you avoid that time and hassle. Once you identify the bills you want paid and when, the service will take it from there. All you have to do is ensure that there's enough money in your account to cover the bills and check in to verify that all the bills were paid.

Using all of the digital tools available for banking can make financial tasks more convenient and give you more time for the things you enjoy. It's worth looking to see how e-banking can help take some stress out of your busy life.

© Copyright 2016 NerdWallet, Inc. All Rights Reserved

Views

Views

Go Back

Go Back