FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

VIEW ALL EDUCATION & INSIGHTS

VIEW ALL EDUCATION & INSIGHTS

February 14, 2014

Feeling the Love: Why You Should Heart Your Cash Management Officer

It’s here. The day of L.O.V.E. And while heart-shaped candy boxes, rosy-cheeked cupids, and adorable heart-hugging teddy bears may make some of you a little queasy, we think this is the perfect time to celebrate one of the most important relationships in your life.

No, we’re not talking about your significant other. We’re talking about your cash management officer, of course! Because, really, where would you be without that person? Struggling with working capital and efficiency, probably.

But your cash management officer, paragon of customer commitment that he/she is, devised the customized and innovative solutions that have helped your business thrive. Good cash management officers are not only interested in winning your business; they’re dedicated to growing your business—engendering your trust and building a relationship of strategic collaboration.

That’s why you should show your heartsy appreciation today for your one and only cash management officer. Whether you send chocolate (we’ll take Lindt, please) or make a card (The Walking Dead style), be sure to thank your CM officer for the incredible benefits he/she bestows upon your business.

1. Expedited Accounts Receivable

Intelligent cash management begins with the efficient collection of receivables. The faster your business receivables are processed, the faster your funds become available, allowing you to put working capital to—where else?—work. Good cash management officers will help you:

- Reduce number of days sales outstanding

- Decrease the rate of NSF (non-sufficient funds) and returned items

- Eliminate trips to the bank

- Accommodate customers’ preferred payment methods

- Improve speed, accuracy, and cost-efficiency

How? They’ll provide you with cutting-edge paper-based and electronic receivable services, including:

Automatic Clearing House (ACH) Origination Services - Secure and inexpensive, ACH origination offers improved efficiency and control. It can be used for pre-authorized collections, check conversion and cash concentration.

Lockbox Services - A company-designated post office box maintained and operated by the bank, which improves availability of funds by reducing mail and processing float. Cash is more readily accessible for deposit, investment, disbursement or debt reduction.

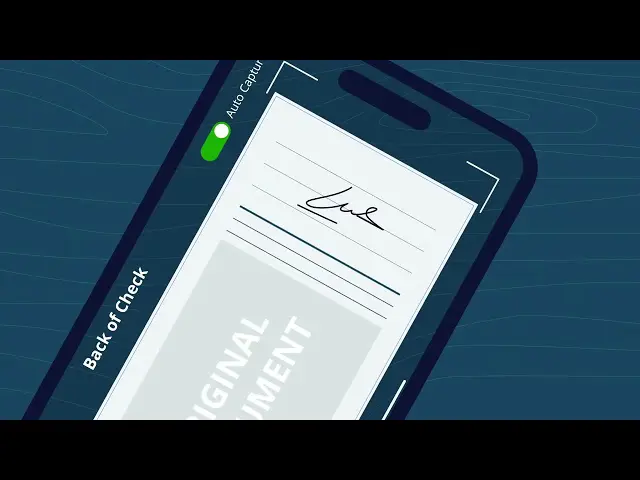

Remote Deposit Capture (RDC) - A check scanner that allows business owners to deposit checks into their account from the convenience of their home or office. Save time and enjoy the convenience of depositing checks the same day you receive them, accessing funds more quickly, and instantly viewing check images, deposits, and reports online.

2. Streamlined Payables

Every relationship requires give and take. And cash management officers make giving so good. They provide comprehensive and customizable payment solutions to increase efficiency, security, information transparency, and reliability:

ACH Origination Services and Wires - Schedule one-time or recurring payments to a single payee or payee group through ACH. Or originate domestic or international wires for disbursements, including direct deposit and vendor payments.

Zero Balance Account (ZBA) - Simplifies the management of funds from multiple accounts. Automatic funding of disbursement accounts or automatic transfers into one centralized account streamline your cash flow and reduce quotidian manual tasks.

3. Optimized Cash Flow and Informed Reporting

The best metaphor we’ve heard to explain cash flow is a bathtub with an open drain. In order to maintain a strong balance sheet, more water needs to be pouring in than draining out. Keeping water in the tub is the foundation of successful cash management. Your CM officer will help ensure that your business has enough cash available to meet all payment needs—as well as those unexpected emergencies.

Cash management solutions offer:

- Financial Forecasting

- Risk Management

- CM Officer Collaboration and Communication

- Expert Advice

- Transparent Reporting

- Investment Safety and Diversification

- Optimized Working Capital

- Accessibility of Funds

Those strategic, end-to-end solutions include:

ProvidentConnect for Business - With this user-friendly online banking portal, become your own chess master with the control, big-picture perspective, flexibility, and insight to manage the little pieces of your business.

- Account Viewing: Monitor your daily cash position, project cash flow, analyze trends, and make borrowing and investing decisions confidently and quickly from the convenience of your home or office.

- Transaction Reporting: Eliminate paper reports and review detailed transaction summaries, account statements, ACH and Wire activity, etc.

Sweep Investment Accounts - Automates the management of your daily balance to maximize earnings on excess cash or pay down debt.

4. Bank Fraud Prevention

As we’ve already discussed, the dangers of fraud are pernicious and real. That’s why a good cash management officer will have your back when it comes to security precautions:

ACH Blocked Account – Positive Authorization - Protects your account from unauthorized ACH activity. Only predetermined ACH entities will post to the account.

Positive Pay – Compares checks presented for payment to an issue file by account number, check serial number, and dollar amount. Payee Verification also compares the payee field. This allows you to reject unauthorized payments before incurring loss.

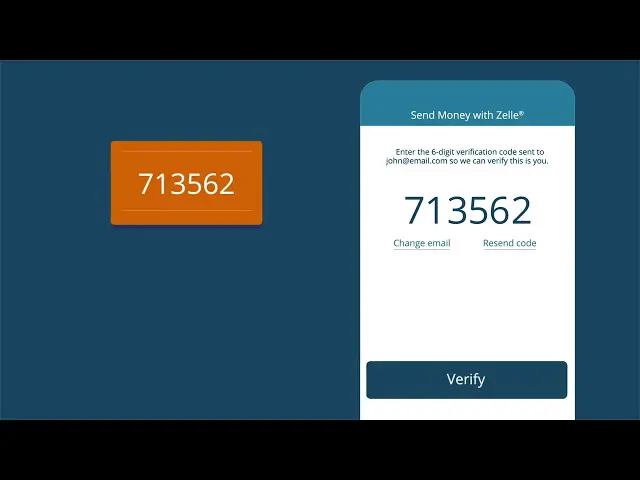

Authentication Tools – Authentication tools use methods ranging from simple to complex, single-factor to multi-factor to verify the identity of a user when logging into an online banking session.

- Security Tokens: Tokens are pocket-sized devices that either connect to your computer or generate a one-time password every 30-60 seconds that must be entered into the login screen.

- Out-of-Band Authentication (OOBA): When a user’s login attempt or transaction initiation seems suspicious or risky, deviating from the normal processing environment or transaction history, OOBA requires you to identify yourself via a second channel.

Feeling the Love

If you’re looking for your own heart-worthy cash management officer, please contact one of ours!

How does your cash management officer enrich your business? Weigh in!

Views

Views

Go Back

Go Back